Extreme cold that permeated much of the Lower 48 throughout the long Martin Luther King Jr. Day holiday weekend and into the current trading week at once sent natural gas demand soaring and froze wells, causing steep cuts to production that carried into Tuesday.

Temperatures over parts of the Mountain West, Plains and Midwest plunged to around 50 below zero when accounting for wind chills over the weekend. Conditions remained frigid Tuesday.

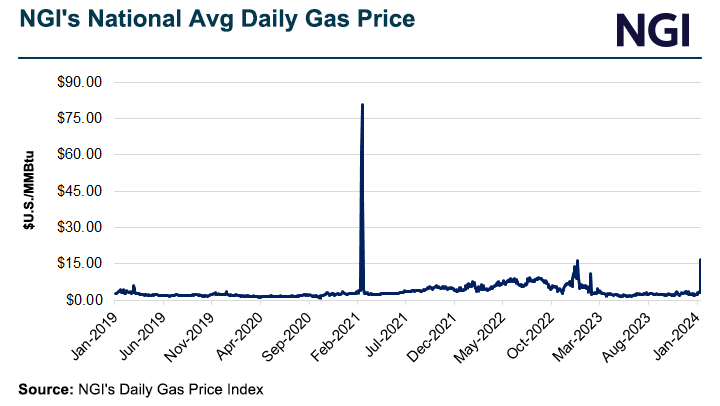

Ahead of that, natural gas cash prices ballooned last Friday, when NGI’s Spot Gas National Avg. spiked $13.450 to $16.770 and reached the highest level since 2021. That year, Winter Storm Elliott ushered in brutal winter conditions to Texas that forced deadly power outages and contributed to a massive production drop of more than 20 Bcf/d.

The “anomalous” weather event of the past few days caused “profound effects on both supply and demand,” said Rystad Energy analyst Ademiju Allen.

Underground inventories that utilities built ahead of winter serve as “a buffer to production where there are constraints on natural gas processing plants and transportation,” but the stratospheric move in cash prices will trigger record withdrawals from storage this week,” Allen added.

While the February Nymex contract gave up ground Tuesday amid forecasts for mild weather later this month – the prompt month fell below the $3.00/MMBtu handle intraday -- it had rallied last week. It settled at $3.313/MMBtu on Friday, up 21.6 cents on the day and ahead 15% for the week.

Cash prices retreated Tuesday, too, but NGI’s national average still held around $6.00 – twice the level it started the year.

The bitter cold -- freezing temperatures also descended into Texas and neighboring southern states – not only galvanized national demand but stressed pipeline networks and electric grids.

Wood Mackenzie estimates showed Lower 48 demand surged nearly 30% from last Friday to Tuesday of this week, topping 145 Bcf/d and soaring past the recent 30-day average of about 110 Bcf/d.

Production dropped to a low of 92.4 Bcf/d on Monday and remained low at 94.6 Bcf/d on Tuesday, according to Wood Mackenzie estimates. Output averaged about 99 Bcf/d over the last seven days, far from near-record highs above 106 Bcf/d to start 2024.

Wood Mackenze expects the output average for the remainder of this week to fall just shy of 99 Bcf/d amid a gradual recovery from the bitter cold.

Freeze-Off Toll

“Freeze-offs are taking their toll,” particularly in the Rockies, Plains and Midwest, Wood Mackenzie analyst Ricardo Falcon Bautista said.

Challenges were widespread, he said, with the Midwest enduring the harshest conditions. Northern Border Pipeline, for example, set an Operational Flow Order on several receipt locations over the weekend. Persistent losses of supply into the Midwest required it to declare a force majeure on Monday that remained in place as the trading week got underway.

Also Monday, ANR Pipeline Co. declared a force majeure because of an unexpected outage at the LaGrange Compressor Station in Indiana. It warned of flow reductions that could last until Jan. 25.

These two force majeures were “sending shockwaves to the interconnecting” Northern Natural Gas Co. system in the Midwest and Midcontinent, Bautista said. He noted the company cautioned of protracted supply challenges that it linked directly to the frosty weather.

Northern Border Ventura prices skyrocketed more than $30 on Friday, according to NGI data.

Challenges spanned from the Northwest to the East, however, with potential problems impacting markets as far south as Texas.

With freezing temperatures expected to drive up demand, grid operator ERCOT (aka the Electric Reliability Council of Texas) had issued a conservation notice as of early Tuesday asking for customers to reduce electricity use.

‘Serious Grid Reliability Threat’

EBW Analytics Group noted declines in the Haynesville Shale and Permian Basin that, while modest relative to areas of the North, added to concerns in Texas.

EBW analyst Eli Rubin said that because of robust storage supplies ahead of the winter storms of recent days, significant power outage risks in ERCOT were “small” on Tuesday, with morning forecasts for load to peak at 82.3 GW.

As recently as Monday, however, ERCOT had warned that loads could exceed 87 GW, which would surpass the highs of last summer by 1.5 GW and “pose a serious grid reliability threat,” Rubin noted.

NatGasWeather said “national demand will remain strong to very strong through mid-week,” including “hard freezes deep into Texas and the South.”

The forecaster said “a reinforcing cold shot will follow into the U.S. Jan 19-21” to keep “demand strong to very strong” before a reprieve begins. Next week, temperatures are projected to shift to above average over most of the country, the firm said.

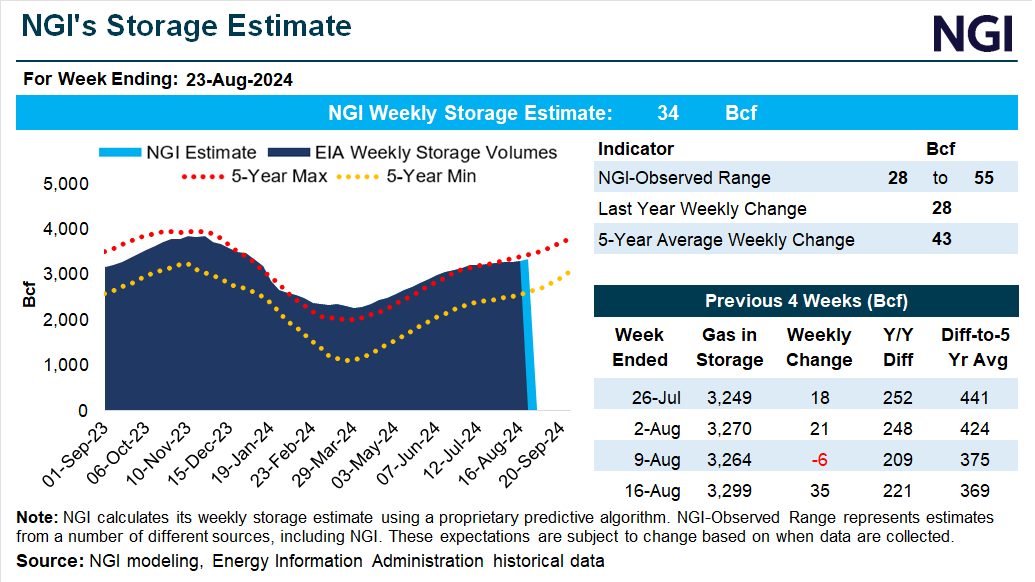

That noted, the current conditions are expected to drive the biggest storage withdrawal of the season by far for the week ending Jan. 19. NatGasWeather said early estimates are likely to range from 260 Bcf to 340 Bcf.

Such a pull would easily eclipse expectations for a draw of around 120 Bcf to 170 Bcf for the week ended Jan. 12 and an actual decrease of 140 Bcf for the first week of 2024.

Rystad’s Bautista said the deep freeze this month reminded the market that “unpredictable factors such as weather can put a market on a new trajectory.”