Impressive heat in the forecast for the second half of June sparked a rally in the natural gas forwards markets from June 6-12, with double-digit gains spread across most of the Lower 48, according to NGI’s Forward Look.

While fixed prices for July continued to average well below $3.000/MMBtu, benchmark Henry Hub moved across that threshold after gaining 22.3 cents through the week to hit $3.051, Forward Look data showed. Prices for the balance of summer (July-October) were up similarly and averaged $3.115.

NatGasWeather said the eight- to 15-day outlook showed searing heat across most of the country. Highs in the 90s were expected to stretch into the Northeast, while areas from California to Texas could see daytime temperatures in the low 100s. As such, cooling degree day totals for June 17-27 were forecast to be near all-time records, according to the forecaster.

As far as the impact on gas storage, “The net result will be for surpluses to steadily decline through June, then likely to decrease further in early July,” NatGasWeather said. “We view this as being a major reason prices have been so strong.”

The U.S. Energy Information Administration (EIA) said storage inventories rose by 74 Bcf for the week ending June 7, lifting stocks to 2,974 Bcf. Notably, storage levels remained well above historical levels 10 weeks into the injection season – at 364 Bcf above last year and 573 Bcf above the five-year average. At the end of the winter withdrawal season, stocks were 422 Bcf above year-earlier levels and 633 Bcf above the five-year average.

EBW Analytics Group LLC noted that technical indicators also pointed to the potential for prices to reach the low $3.40s before entering oversold territory. This could mean the market sees some consolidation in the next week to 10 days.

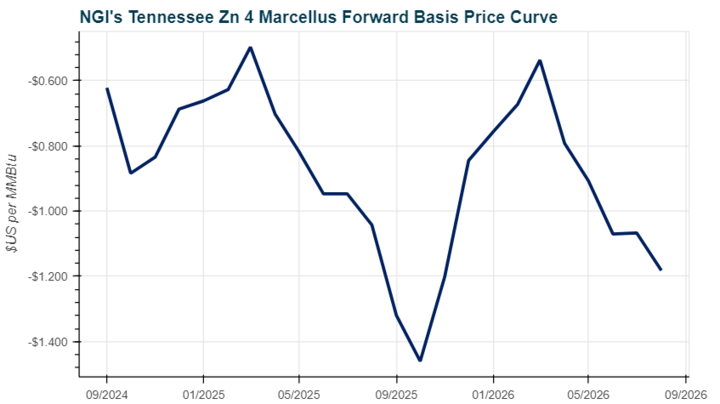

That said, recent production readings suggested that supply was lower at the beginning of the month. As EBW’s Eli Rubin, senior natural gas analyst, pointed out, this is because Henry Hub prices have skyrocketed, while Appalachia prices remained in a slump.

To be sure, July forward prices at Eastern Gas South barely hit $2.021 on Wednesday, while the balance of summer was lower, Forward Look data showed. It isn’t until the winter when prices at the Appalachia benchmark were expected to rise to around $3.000.

“The timing of production returning to the market remains an enormous question mark with uncertainty elevated,” Rubin said.

He noted that EQT Corp. already has begun to return curtailed supply, while Chesapeake Energy Corp. indicated it is waiting to drain excess storage inventories from the market.

“Still, many producers facing historically weak pricing this spring opted to delay bringing new wells online until the summer,” Rubin said. Another big natural gas producer, Coterra Energy Co., “alone noted 12 wells over two pads deferred amid low prices that it would bring online in July. Others in need of cash flow likely adopted a similar trajectory.”

LNG demand also comes into play later in the year. Rubin noted that initial feed gas flows into the Plaquemines liquefied natural gas export terminal in Louisiana or Altamira LNG in Mexico may be rather inconsequential. However, the bullish sentiment alone could fuel prices. Altamira was expected to ship its first cargo this month.

The past week’s price action backs up this theory. Nymex futures swung wildly this week as Mountain Valley Pipeline neared startup, even though initial volumes were not expected to be anywhere close to the 2 Bcf/d of capacity.

“While fundamental impacts may remain minimal during the initial commissioning phase, the boost to sentiment from the first new LNG facilities coming online in two years may provide a sentiment boost – furthering risks of the Nymex rally overshooting to the high side,” Rubin said.

Weak California Basis

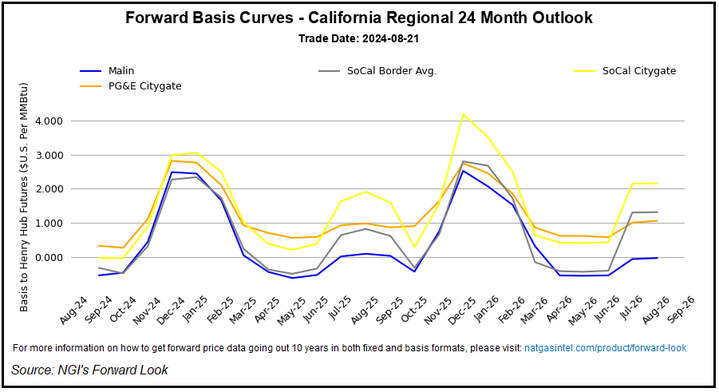

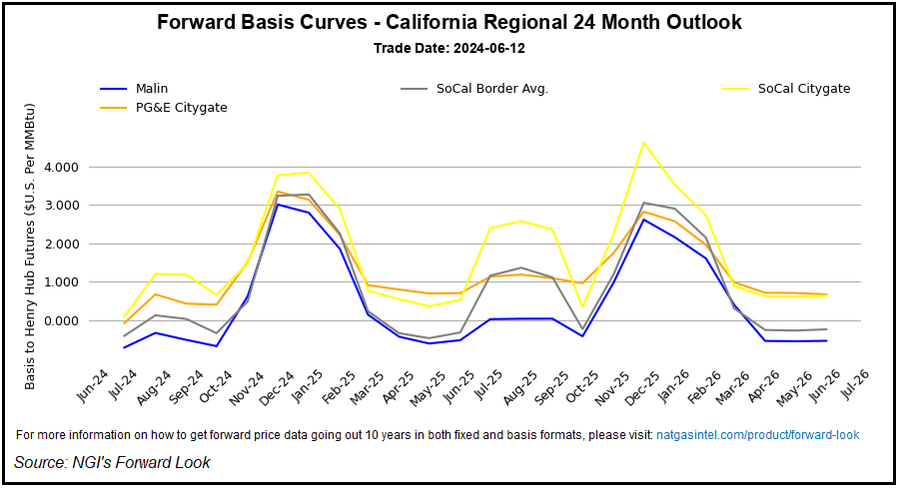

California markets were not immune to the rise in forward prices. However, soft basis pricing reflected a region that, despite a forecast to see scorching conditions in the coming weeks, continues to be well-supplied.

SoCal Citygate July basis fell 15.0 cents through the period to reach plus 9.5 cents, according to Forward Look. In Northern California, PG&E Citygate July basis dropped 11.5 cents to reach minus 6.9 cents.

For comparison, basis prices across the Lower 48 averaged less than a nickel lower from June 6-12.

RBN Energy LLC’s Lisa Shidler said California’s extensive renewable energy buildout and higher-than-normal hydropower resources were keeping a lid on power costs and by extension, natural gas demand.

The analyst noted that in February, a pair of “atmospheric rivers” – large, narrow sections of the atmosphere that carry moisture from the tropics near the equator to the poles – drenched California. This bolstered the hydroelectric power generation system by filling reservoirs and building up snowpack levels.

The California Department of Water Resources, which monitors conditions at 17 reservoirs, indicated that as of June 11, all but one reservoir was above the historical average for that date. Thirteen were at least 90% full.

A good example is Lake Oroville in Northern California, which was at 100% capacity and at 127% of the historical average, Shidler noted. As important, historically low water levels at this reservoir in 2021 forced the shutdown of the Edward Hyatt Power Plant. It was the first time it had done so since opening in 1967.

“Water levels are marginally higher than a year ago but up 16% from 2022,” Shidler said. Hydropower is expected to account for about 14% of California’s electricity generation in 2024, around the historical average, according to EIA.

In July 2021, EIA pegged hydropower making up only 6% of California’s power load.

Still, Shidler added that “while California is adding plenty of renewable generation, any downturn in hydropower brought on by a return of drought-like conditions could quickly complicate things.”