Natural gas forwards advanced across portions of the East from June 13-18, bolstered by sweltering forecasts and a new pipeline expanding the reach of Appalachian Basin gas, according to NGI’s Forward Look.

However, gains in the Northeast, Midwest and Appalachia were offset by declines in other regions, leaving July fixed prices down by around a penny on average during the period, Forward Look data showed. The benchmark Henry Hub shed 5.2 cents to finish at $2.914/MMBtu, similar to a 5.0-cent slide in Nymex futures over the same time frame.

The National Weather Service (NWS) said a heat wave would persist over the Great Lakes, Ohio Valley and portions of the Northeast into the weekend, then intensify over western states next week. NWS data pointed to severe heat spreading into the South this weekend and the lower Midwest and Southwest early next week.

Weather models shed some demand for the next 15 days on Thursday, but were “still the hottest of the past 45 years” for cooling degree days for the period, NatGasWeather said.

With the heat’s bullseye on their back, Northeast and Midwest hubs led fixed prices higher with increases in the low double-digits over June 13-18. Algonquin Citygate near Boston added 14.0 cents to close out the trading period at $3.314, Forward Look data showed. Michigan Consolidated gained 10.2 cents to $2.408.

ISO New England issued an alert Tuesday after some power generation unexpectedly tripped and other power producers were unable to come online before peak evening demand, spokesperson Mary Colapietro told NGI. The grid operator projected that demand would reach 23,900 MW Thursday evening, the highest level of the season, before easing on Friday when the heat was expected to subside over New England.

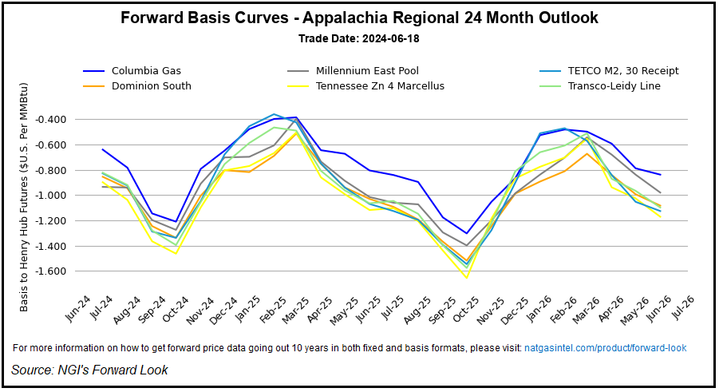

The trading period also brought with it the startup on June 14 of the long-delayed Mountain Valley Pipeline LLC (MVP), expected to ship gas at a fraction of its 2 Bcf/d capacity until downstream bottlenecks are cleared in the years ahead.

The market got its first read on what those levels would look like during the trading period.

Initial flows since Saturday (June 15) were as high as about 410 MMcf/d, according to MVP flow data. Notably, that amount of gas made it onto the Transcontinental Gas Pipe Line Co. LLC (Transco) system via the Cherrystone interconnect. Cherrystone is one of two receipts listed for MVP, in addition to six delivery points. It is through this route MVP’s gas can flow to Southeast markets.

Criterion Research LLC has estimated Transco has spare summer capacity to take around 200-300 MMBtu/d of additional gas flows into the Southeast from MVP. East Daley Analytics has said MVP could average 750 MMcf/d for the remainder of this year, which includes post-summer flows when more capacity opens up.

“These constraints will limit flows until 2027, when Transco debottlenecks downstream through its Southeast Supply Enhancement expansion,” analysts at East Daley said.

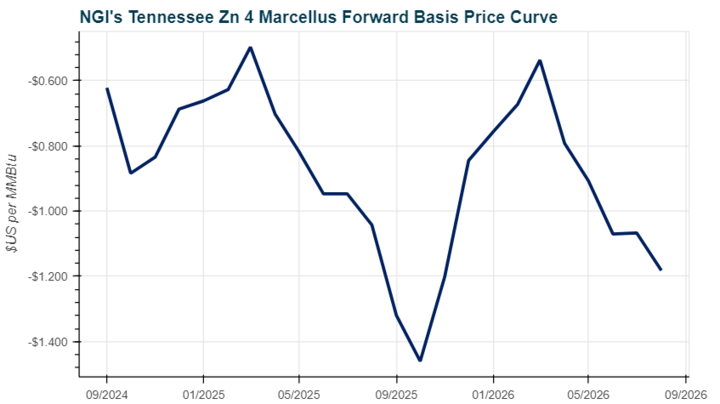

Given pipeline constraints, MVP’s price support for Appalachian hubs continued to be modest. July fixed prices for Texas Eastern M-2, 30 Receipt tacked on 3.7 cents to $2.080 during the period.

Taking advantage of the MVP startup, EQT Corp., with 60% of the pipeline’s capacity, is bringing back 1 Bcf/d of output curtailed earlier this year. CEO Toby Rice said the pace would be set in part by prices. Flow data indicate EQT has brought back two-thirds of its idled capacity.

Along with gains in the Permian Basin and Haynesville Shale, the added supply has pushed Lower 48 natural gas production back above 100 Bcf/d after it slipped below that level in early June. Daily production averaged 101 Bcf/d over the seven days to Thursday, Wood Mackenzie data show.

For Henry Hub prices, that recovery in overall production counteracted price support from record heat forecasts. But for the rest of North America, basis differentials widened by an average 3.5 cents over the period, as record hot forecasts possibly held more sway than supply.

West Coast Basis Weaker

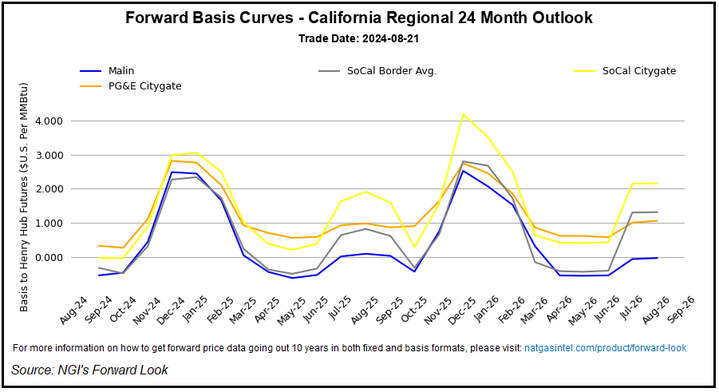

The main exceptions for those basis gains were in the western half of the country. The Pacific region remains well-supplied with natural gas as storage levels are much higher than a year ago. In addition, California has abundant hydropower resources at its disposal, in contrast to a year ago when dry conditions forced natural gas to fill the gap.

SoCal Citygate July basis fell 14.5 cents through the period to flip negative to minus 14.0 cents, according to Forward Look. In Washington State, Northwest Sumas July basis dropped 23.7 cents to reach minus $1.211.

On the demand side, the Northwest was expected to be relatively cool in the second half of June, NWS data showed. The same forecasts have not spared California from the heat, with above-normal conditions, while much-above levels were forecast for the Rockies and Northeast Texas.

Tropical storms have begun to be a factor for the South Central region and Mexico markets. The first named storm of the Atlantic season, Tropical Storm Alberto, made landfall in Mexico early Thursday. The storm “remains a large system and continues to produce moderate coastal flooding across portions of southern Texas,” the National Hurricane Center said.

In the storm’s wake, cooler temperatures were expected in Texas, and as a result, lower cooling demand. But the effect on basis prices was modest, with hubs across the state mixed in the single digits during the period.

Agua Dulce July basis shed 2.2 cents to finish at minus 33.0 cents. Waha July basis added a penny to finish at minus $1.504.