Natural gas futures rallied after a government report showed a remarkable August decrease in storage. Analysts interpreted it as a bullish sign of supply/demand tightening after a hot summer and lower production levels. By early afternoon, however, profit-taking dropped the front month into a narrow range of gains and losses.

Here’s the latest:

- September Nymex gas trading down 2.5 cents to $2.194/MMBtu as of 2:20 p.m. ET

- U.S. Energy Information Administration (EIA) reports a withdrawal of 6 Bcf for Aug. 9 period

The Thursday morning EIA print initially sent futures headed toward a seventh gain in eight sessions. It was the first August inventory draw in records dating to 2010, according to NGI’s Pat Rau, Senior Vice President of Research & Analysis.

The EIA pull was driven by a whopping 27 Bcf decrease in South Central storage, where robust heat and weaker wind generation powered strong natural gas demand. The region reported multiple draws this summer and could post more ahead. As a result, EBW Analytics Group’s Eli Rubin, senior analyst, said the national increase in storage for all of August is on track “to be the smallest since at least 2000.”

The EIA report lowered U.S. storage to 3,264 Bcf. That left stocks 13% above the five-year average, though two percentage points lower than the prior week and far from the 2024 peak around 40% in March.

- U.S. LNG export facilities scheduled to receive around 12.3 Bcf of feed gas Thursday, in line with the seven-day average, per Wood Mackenzie

- Production holds close to 100 Bcf/d – well below summer highs near 103 Bcf/d

Wood Mackenzie said liquefied natural gas volumes held steady in mid-August and projected they would remain so through the coming week as importers of U.S. LNG begin to call for supply to brace for the coming winter. These include buyers in densely populated Asia and Europe.

The firm also said output remained relatively light this week amid maintenance projects in several regions. The firm estimated Thursday’s production at 100.4 Bcf/d, down from the 30-day average of 102 Bcf/d.

- NGI’s Spot Gas National Avg. down 4.0 cents to $1.630, according to NGI’s MidDay Price Alert

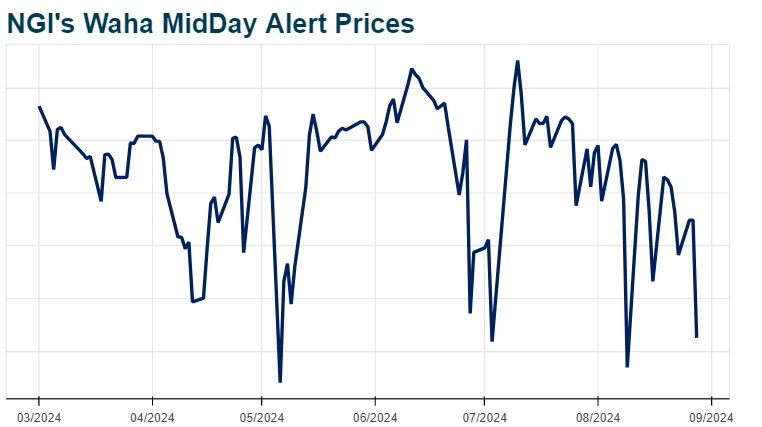

- Waha in West Texas continues to struggle, off 94.5 cents to negative $1.340

Lower flows of supply and looming widespread heat bolstered cash prices in most regions on Thursday, but a lingering supply glut in the Permian Basin kept heavy pressure on West Texas prices. The national average was a few ticks lower at midday as a result.

National Weather Service data showed benign conditions in the North through this week but hot high temperatures in the week ahead. Scorching heat in the South was projected to continue through late August, fueling strong national cooling demand.

Meanwhile, Hurricane Ernesto was not expected to have a major impact on the Lower 48. The National Hurricane Center (NHC) said the storm battered Puerto Rico Wednesday with torrential rains and widespread power outages before it headed toward Bermuda. On its current path, it would avoid a direct strike on the U.S. mainland, though NHC forecasters cautioned that Ernesto’s strong winds and ocean swells could reach as far as the Lower 48 East Coast.

Against that backdrop, another weak storage print may lie ahead. Early estimates submitted to Reuters for the week ending Aug. 16 ranged from a withdrawal of 3 Bcf to an injection of 52 Bcf, with an average increase of 33 Bcf. The estimates compare with a five-year average increase of 41 Bcf.