Natural gas futures on Friday forged ahead through midday trading, putting the prompt month on target for its fourth gain in as many sessions, though it pulled back and hovered near even by early afternoon. Weakness in West Texas pressured spot prices lower.

Here’s the latest:

- September Nymex gas contract trading up eight-tenths of a cent to $2.135/MMBtu as of 2:25 p.m. ET

- Production held lower and analysts look for another bullish storage print

Wood Mackenzie estimated production at 100.4 Bcf/d on Friday, down from a prior seven-day average near 102 Bcf/d. It cited a series of maintenance projects in Appalachia, the Permian Basin and the Rockies.

The lighter production offset mild temperatures in the North this week as well as fallout from former Hurricane Debby. It made landfall in Florida on Monday as a Category 1 storm. Its strong winds caused power outages and ushered in cooling air.

Additionally, analysts at Gelber & Associates noted elevated levels of short covering that contributed to recent buying. “Major market players across the board continued to reduce their short positions,” they said.

With natural gas output relatively soft in early August, analysts anticipated another anemic storage print for the week ending Aug. 9. Preliminary estimates submitted to Reuters ranged from a withdrawal of 8 Bcf to an injection of 30 bcf, with an average increase of 19 Bcf. The estimates compare with an increase of 33 Bcf a year earlier and a five-year average build of 43 Bcf.

The U.S. Energy Information Administration (EIA) on Thursday reported an injection of 21 Bcf into storage for the week ended Aug. 2. The EIA result was far below the five-year average build of 38 Bcf.

It marked a second consecutive bullish build and narrowed a long-running surplus to the five-year by a percentage point to 15%.

In addition to forecasts for widespread heat and strong power burns in the second half of August that could also bolster cash prices, “the market appears to be increasingly pricing in recent production losses” and “a historically small August injection” pace, said EBW Analytics Group analyst Eli Rubin.

- NGI’s Spot Gas National Avg. sheds 16.0 cents to $1.365 at midday

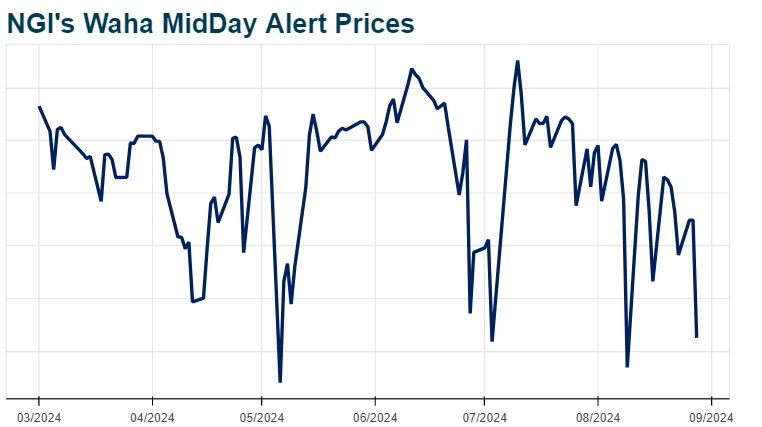

- Waha falls deep into negative territory, according to NGI’s MidDay Price Alert

Cash prices fell under the weight of bearish near-term weather. A supply glut in West Texas amid the Permian maintenance projects this week compounded matters. Regional benchmark Waha dropped $3.195 at midday to average negative $4.305.

On the demand front, NatGasWeather said Friday “the Midwest, Plains, Ohio Valley and East will see highs of upper 60s to lower 80s through early next week as weather systems track through with showers and thunderstorms, including widespread rains from remnants” of Debby “spreading northward up the East Coast the next few days.”

However, the firm added, “much of the western and southern U.S. will remain very warm to hot with highs of upper 80s to 100s, hottest California to Texas.” Those conditions are forecast to expand in the third full week of August on the back of “hot upper high pressure” that “will rule most of the U.S. with highs of mid-80s to 100s.”